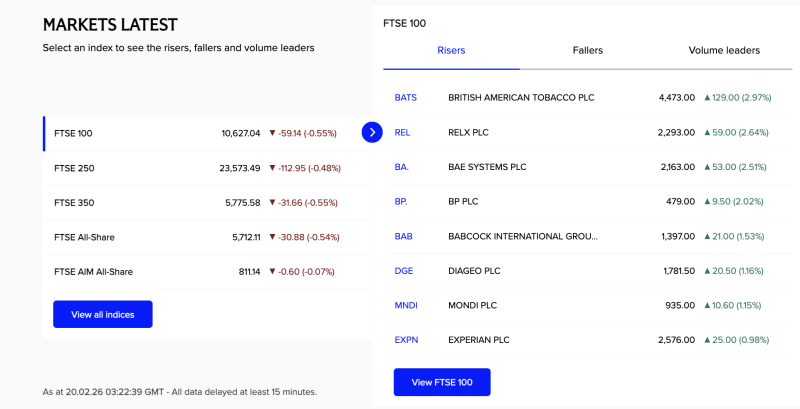

London — The FTSE 100 ended lower on Friday, down 0.55% as broader selling pressure offset pockets of strength in select large-caps. Weakness among heavyweight sectors kept the benchmark in the red despite noticeable rallies in consumer and energy names.

By close, the FTSE 100 stood at 10,627.04, shedding 59.14 points, while the mid-cap and broader gauges also declined — the FTSE 250 slid 0.48% and the FTSE 350 dropped 0.55%. The All-Share index was down 0.54%, signaling broad market retracement.

Stocks in Focus

Top advancers on the FTSE 100 included:

British American Tobacco PLC (BATS) jumped 2.97%, outperforming peers as defensive demand picked up.

RELX PLC (REL) climbed 2.64%, buoyed by steady earnings outlook.

BAE Systems PLC (BA.) gained 2.51% on renewed defense sector interest.

BP PLC (BP.) rose 2.02%, finding support on higher oil prices.

Babcock International Group (BAB) added 1.53%.

Diageo PLC (DGE) and Mondi PLC (MNDI) advanced 1.16% and 1.15%, respectively.

Experian PLC (EXPN) ended up 0.98%.

However, these stock-specific rallies were not enough to lift the market overall, as selling pressure remained widespread in financials and cyclicals.

Sector & Market Dynamics

Energy names saw mixed performance with BP outperforming, reflecting continued crude strength.

Consumer staples and defensive stocks attracted safe-haven buying amid increasing volatility.

Broader market breadth stayed weak, pointing to distribution in mid and small caps alongside large-cap rotation.

Market Context

The FTSE’s decline comes on the heels of elevated geopolitical tensions and higher commodity prices, which have dampened risk sentiment. Traders noted that volatility remains elevated, and while individual stocks delivered gains, macro headwinds limited broad market advances.