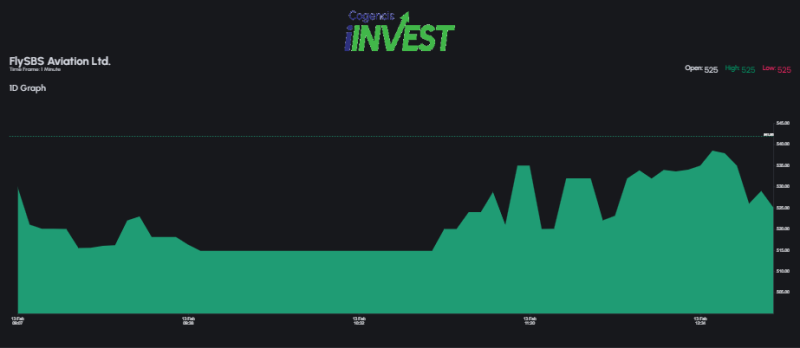

Mumbai, February 13, 2026 – FlySBS Aviation Ltd. (FLYSBS) reported robust revenue growth in FY25, with total revenue jumping 91% YoY to ₹1,950.84 Cr from ₹1,021.21 Cr in FY24, driven by higher net revenue from operations at ₹1,938.90 Cr. However, escalating costs—led by materials expense at ₹1,449.34 Cr (up 74.6% YoY)—tempered margins, though profit before tax still rose 197% to ₹300.01 Cr. The NSE data highlights the company's expansion in aviation services, with employee benefits spiking 615% to ₹46.34 Cr amid operational scaling.

The P&L trends reflect FlySBS's growth trajectory over five years, with consistent revenue upticks but volatile tax and depreciation adjustments. Overall, FY25 current tax climbed to ₹103.49 Cr from ₹19.31 Cr, underscoring improved profitability despite finance costs more than doubling to ₹20.99 Cr.

FlySBS Key P&L Metrics (Consolidated, in ₹ Cr)

Snapshot of the profit and loss statement for Mar-25 to Mar-21:

| Description | Mar-25 | Mar-24 | Mar-23 | Mar-22 | Mar-21 |

|---|---|---|---|---|---|

| Total Revenue | 1,950.84 | 1,021.21 | 346.83 | 106.87 | 34.07 |

| Net Revenue from Operations | 1,938.90 | 1,006.87 | 340.07 | 106.87 | 34.07 |

| Other Income | 11.94 | 14.34 | 6.76 | 0 | 0 |

| Total Expenditure | 1,650.83 | 920.05 | 300.67 | 92.05 | 30.07 |

| Cost of Materials Consumed | 1,449.34 | 829.82 | 278.82 | - | - |

| Employee Benefits Expense | 46.34 | 6.48 | 7.17 | - | - |

| Finance Costs | 20.99 | 8.00 | 1.00 | - | - |

| Depreciation, Depletion and Amortization Expense | 3.18 | 2.71 | 0.13 | - | - |

| Other Expenses | 430.98 | 13.04 | 6.55 | - | - |

| Profit Before Tax | 300.01 | 101.16 | 46.16 | 14.82 | 4.00 |

| Total Tax Expense | 103.92 | 28.67 | 6.78 | - | - |

| Current Tax | 103.49 | 19.31 | 6.58 | - | - |

Key Spotlights:

- Revenue Acceleration: FY25 total revenue nearly doubled YoY to ₹1,950.84 Cr, propelled by operational scaling—up from ₹346.83 Cr in FY23.

- Cost Surge: Materials expense ballooned 74.6% to ₹1,449.34 Cr in FY25, driving total expenditure to ₹1,650.83 Cr (up 79.4% YoY).

- Profit Growth: Before-tax profit soared 197% to ₹300.01 Cr in FY25, with tax expense rising to ₹103.92 Cr—indicating stronger bottom line.

- Employee and Finance Pressures: Employee costs jumped 615% to ₹46.34 Cr, while finance costs more than doubled to ₹20.99 Cr, highlighting expansion challenges.

Value hunters may eye FlySBS (LTP ₹522.00, down 1.32%) for its revenue momentum, but downside risks linger if FII selling continues. Watch Q4 earnings for turnaround. BSE/NSE data; levels as of latest close.