Mumbai, February 13, 2026 – Oracle Financial Services Software Ltd. (OFSS) reported steady operating cash flows in FY25, with net cash from operating activities at ₹1,890 Cr, a marginal increase from ₹1,848 Cr in FY24, despite challenges like rising trade receivables adjustments. The NSE data shows consistent cash generation over five years, underscoring the company's resilience in the fintech sector amid global economic pressures. However, adjustments for trade receivables showed a significant outflow of ₹528 Cr in FY25, up from ₹240 Cr in FY24, highlighting collection delays.

The cash flow trends reflect OFSS's focus on operational efficiency, with positive adjustments for financial costs and fixed asset sales, but negative impacts from trade payables and current liabilities. Overall, the company maintained a strong position, with FY25 operating activities before tax at ₹4,310 Cr, up from ₹2,636 Cr in FY24.

OFSS Cash Flow Highlights (Consolidated, in ₹ Cr)

Snapshot of key rows from the NSE cash flow statement for Mar-25 to Mar-21:

| Description | Mar-25 | Mar-24 | Mar-23 | Mar-22 | Mar-21 |

|---|---|---|---|---|---|

| Net Cash Flow from Operating Activities | 1,890 | 1,848 | 1,007 | 1,588 | 1,565 |

| Operating Activities Before Tax | 4,310 | 2,636 | 2,343 | 2,376 | 2,170 |

| Adjustments for Financial Costs | 0 | 0 | 32 | 33 | 4.79 |

| (Profit)/Loss on Sale of Fixed Assets | - | -0.22 | - | - | -0.06 |

| Adjustments for Decrease (Increase) in Trade Receivables | -528 | -240 | -199 | -182 | -328 |

| Adjustments for Decrease (Increase) in Other Current Assets | 131 | -44 | 179 | -43 | -281 |

| Adjustments for Increase (Decrease) in Trade Payables | 21 | -33 | 77 | -18 | -88 |

| Adjustment for Increase (Decrease) in Other Current Liabilities | -168 | 265 | -177 | 888 | -231 |

Key Spotlights:

- Operating Cash Stability: FY25 net cash from operations rose slightly to ₹1,890 Cr from ₹1,848 Cr in FY24, driven by higher before-tax activities at ₹4,310 Cr (up 63.5% YoY).

- Receivables Pressure: Major drag from trade receivables adjustments at ₹-528 Cr in FY25, more than double FY24's ₹-240 Cr, indicating collection challenges.

- Fixed Asset Gains: Minor positive from fixed asset sales in FY24 (₹-0.22 Cr loss), but negligible in other years.

- Liabilities Fluctuations: Other current liabilities adjustment swung from +265 Cr in FY24 to -168 Cr in FY25, reflecting volatility in working capital.

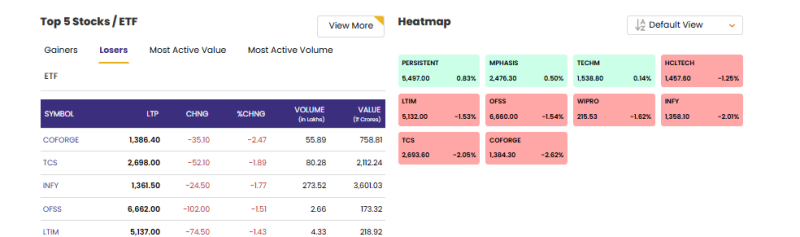

Value hunters may eye OFSS (LTP ₹6,638, down 1.48%) for its consistent cash generation (avg ~1,660 Cr over 5 years), but downside risks linger if FII selling continues. Watch Q4 earnings for turnaround. NSE data; levels as of latest close.