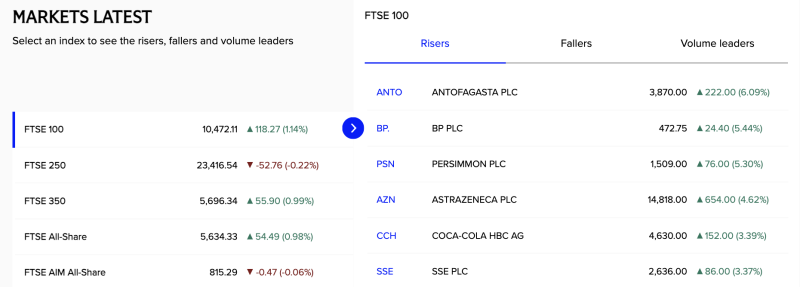

UK equities closed on a firm note with the FTSE 100 rising 1.14% to 10,472.11, supported by broad-based gains across heavyweight blue-chip stocks. Strength in mining, energy, pharmaceuticals, and consumer names drove the benchmark higher, reflecting resilient investor sentiment in large-cap counters.

Among the top gainers, Antofagasta PLC surged 6.09%, leading the rally amid strength in commodity-linked stocks. BP PLC advanced 5.44% on energy sector momentum, while Persimmon PLC gained 5.30% supported by buying in housing and real estate names. Pharmaceutical major AstraZeneca PLC climbed 4.62%, providing strong defensive support to the index, while Coca-Cola HBC AG and SSE PLC also posted solid gains of 3.39% and 3.37%, respectively.

Broader market performance remained mixed, with the FTSE 250 slipping 0.22%, indicating selective strength concentrated in large-cap stocks, while FTSE 350 and FTSE All-Share indices rose nearly 1%, mirroring the positive bias in frontline counters.

Overall, the session reflected sustained institutional accumulation in defensive and commodity-driven blue chips, pushing the FTSE 100 higher and reinforcing bullish near-term sentiment in the UK market.