Global markets witnessed sharp stock-specific action on February 11, with extreme gains and steep declines highlighting heightened volatility and speculative momentum across segments.

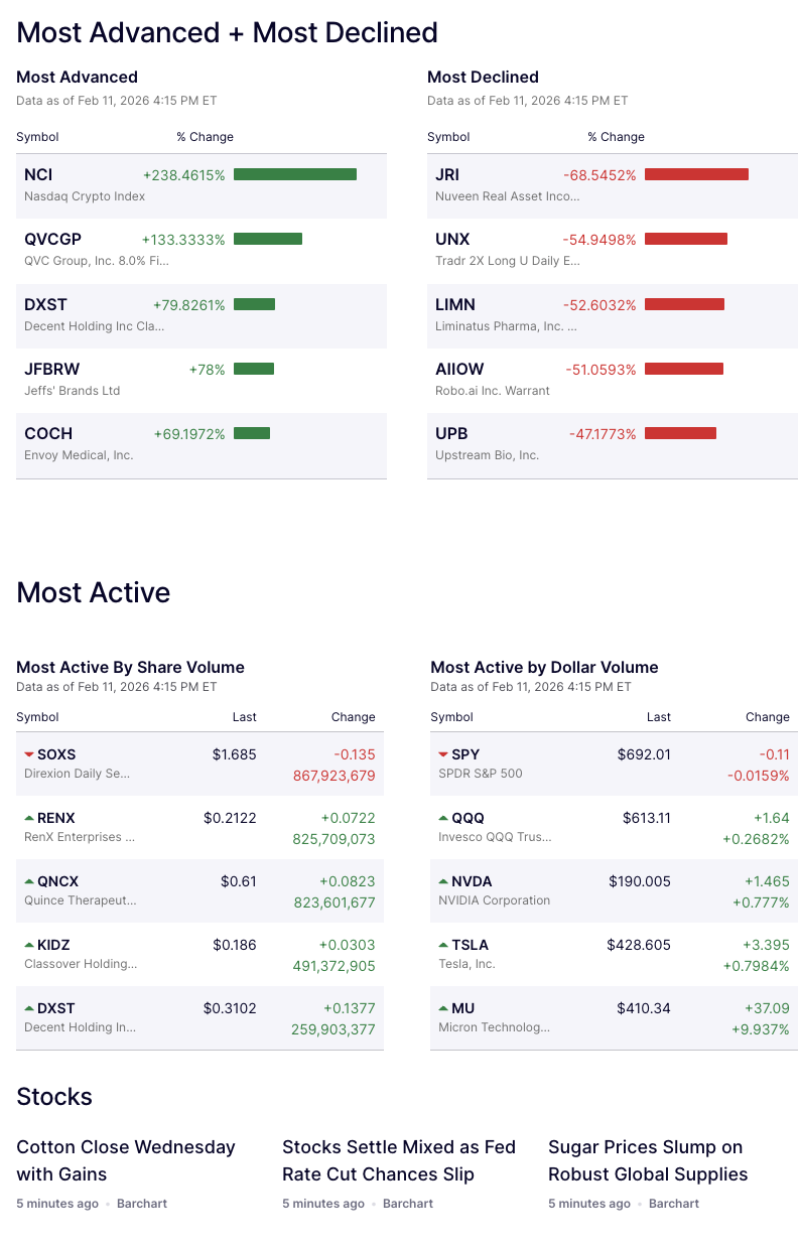

Among the top advancers, NCI (Nasdaq Crypto Index) surged an extraordinary 238.46%, emerging as the session’s biggest gainer. It was followed by QVCGP (+133.33%), DXST (+79.83%), JFBRW (+78%), and COCH (+69.19%), reflecting aggressive risk-on positioning in select microcap and thematic counters.

On the downside, JRI (Nuveen Real Asset Income) plunged 68.54%, leading the decliners’ list amid heavy selling pressure. Other major losers included UNX (-54.95%), LIMN (-52.60%), AIIOW (-51.06%), and UPB (-47.18%), signaling sharp unwinding in leveraged and speculative instruments.

In the most active by share volume category, trading activity remained concentrated in high-turnover counters. SOXS topped the list with over 867 million shares traded, though it closed lower. RENX, QNCX, KIDZ, and DXST also recorded massive volumes, indicating strong retail and momentum-driven participation.

Meanwhile, in dollar-volume leaders, heavyweight technology and ETF names dominated institutional flow. Micron Technology (MU) surged nearly 9.94%, emerging as the strongest mover among large-cap trades. Tesla (TSLA) and NVIDIA (NVDA) also posted gains, while Invesco QQQ (QQQ) edged higher. However, SPDR S&P 500 ETF (SPY) closed marginally lower, reflecting a cautious undertone in the broader market.

Overall, the session underscored a divergence between speculative small-cap momentum and selective strength in large-cap tech, with volatility and liquidity continuing to shape short-term market direction.