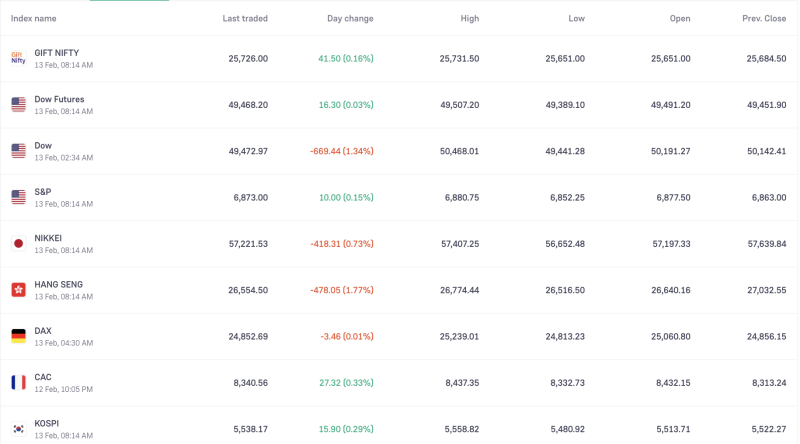

Global equity markets traded mixed on February 13, with weakness in US and Asian indices while select markets showed resilience. Early signals from Gift Nifty suggest a cautiously positive start for Indian equities.

In the US, the Dow Jones Industrial Average declined sharply by 669 points (-1.34%), reflecting selling pressure and investor caution. However, futures trading showed mild recovery, with Dow Futures up 0.03%. The S&P 500 edged higher by 0.15%, indicating selective buying in broader markets.

Asian markets remained under pressure. Japan’s Nikkei fell 0.73%, while Hong Kong’s Hang Seng dropped 1.77%, making it one of the weakest performers in the region. Weak sentiment across Asian equities reflected cautious global risk appetite.

European markets showed mixed movement. Germany’s DAX remained largely flat (-0.01%), while France’s CAC 40 gained 0.33%, signaling stability in select European stocks.

Meanwhile, Gift Nifty traded at 25,726, up 0.16%, indicating a mildly positive to flat opening for Indian benchmark indices. The early trend suggests cautious optimism, though global volatility may keep markets range-bound.

Key Market Snapshot

Gift Nifty: 25,726 (+0.16%)

Dow Jones: -669 pts (-1.34%)

Dow Futures: +0.03%

S&P 500: +0.15%

Nikkei: -0.73%

Hang Seng: -1.77%

DAX: -0.01%

CAC 40: +0.33%

KOSPI: +0.29%

Market Outlook for India

Indian markets are expected to open steady to mildly positive, supported by Gift Nifty gains. However, mixed global cues and weakness in Asian markets may keep volatility elevated. Investors will watch sector-specific momentum, global macro signals, and institutional flows for further direction.