Feb 12, Global Markets: Worldwide equities ended mostly lower after sharp selling pressure in the U.S. triggered a global risk-off wave, while volatility spiked significantly, reflecting rising investor caution across major economies.

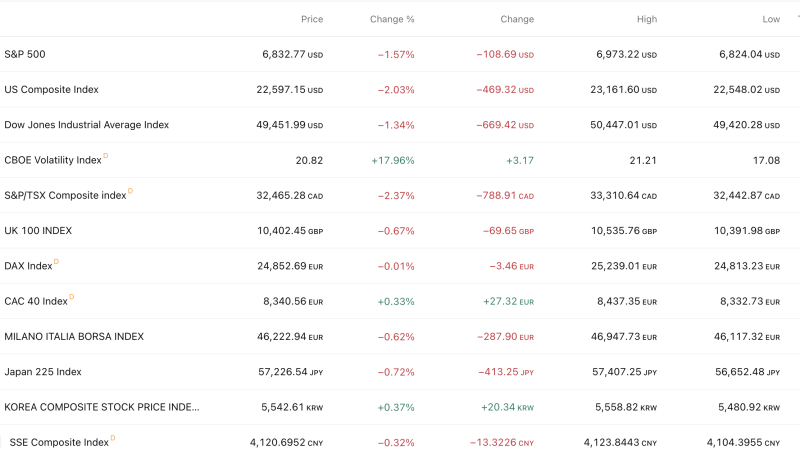

The S&P 500 dropped 1.57% to close at 6,832.77, while the tech-heavy NASDAQ Composite fell 2.03%, marking one of the sharpest single-session declines in recent weeks. The Dow Jones Industrial Average also slipped 1.34%, losing over 669 points, signaling broad-based selling across sectors.

Market fear gauge CBOE Volatility Index surged nearly 18% to 20.82, indicating a sharp spike in hedging activity and investor nervousness amid rising uncertainty and equity weakness.

In Europe, performance remained mixed. Germany’s DAX was nearly flat, slipping marginally 0.01%, while France’s CAC 40 edged up 0.33%, offering limited support to the region. The UK’s FTSE 100 declined 0.67%, weighed down by global sentiment and commodity-linked stocks.

Asian markets also closed mostly lower. Japan’s Nikkei 225 fell 0.72%, tracking U.S. weakness, while China’s SSE Composite Index slipped 0.32%. South Korea’s KOSPI managed to outperform, rising 0.37%, supported by selective buying in technology and export-driven stocks.

Analysts note that rising volatility, profit-booking in global equities, and cautious institutional positioning are driving near-term market direction. Investors are now closely watching macroeconomic signals, liquidity trends, and central bank cues for the next decisive move as global risk appetite remains fragile.