Mumbai, January 23, 2026 – Indian benchmarks extended their choppy January run on Friday, with Nifty 50 dipping 0.91% to 25,059.95 and Sensex down 0.8% (not shown), pressured by persistent FII outflows (₹1,800 Cr net sell) and mixed Q3 earnings from banking and consumer sectors. Major indices like Nifty Bank (down 1.01% to 58,602.45) and Nifty Financial Services (down 1.08% to 26,856.30) led the slide, reflecting rate hike fears and rural slowdown cues amid global commodity volatility. This marks the fifth session of consolidation, with mid-caps underperforming on leverage concerns.

The downturn highlights broader aversion to financials, with volumes average and decliners leading 1.2:1. Analysts at @TheNewsStrike eye potential rebounds if PMI data beats estimates next week, targeting Nifty 25,600 resistance amid Jaipur's trading buzz.

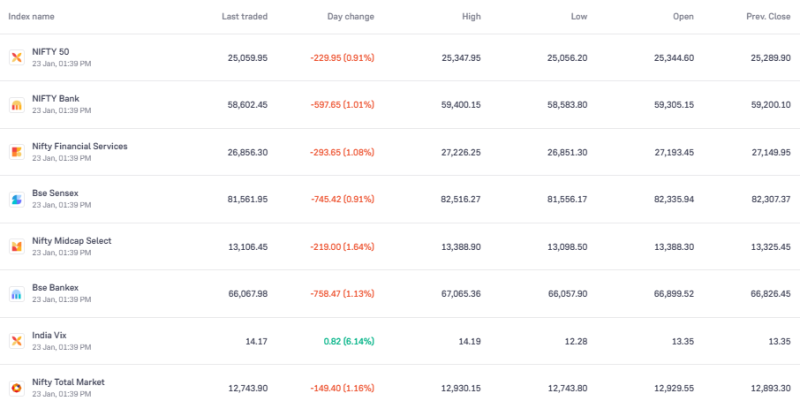

Key Indices Performance Snapshot

Here's the rundown as of 1:39 PM IST on Jan 23, based on NSE data:

| Index Name | Last Traded | Day Change | High | Low | Open | Prev. Close |

|---|---|---|---|---|---|---|

| Nifty 50 | 25,059.95 | -229.95 (-0.91%) | 25,347.95 | 25,056.20 | 25,346.40 | 25,289.90 |

| Nifty Bank | 58,602.45 | -597.85 (-1.01%) | 59,400.15 | 58,883.80 | 59,305.15 | 59,200.10 |

| Nifty Financial Services | 26,856.30 | -293.65 (-1.08%) | 27,226.25 | 26,851.30 | 27,194.45 | 27,149.95 |

| BSE Sensex | 81,561.95 | -745.42 (-0.91%) | 82,516.27 | 81,566.17 | 82,385.84 | 82,307.37 |

| Nifty Midcap Select | 13,106.45 | -219.00 (-1.64%) | 13,388.90 | 13,098.50 | 13,388.30 | 13,325.45 |

| BSE Bankex | 66,069.98 | -758.47 (-1.13%) | 67,056.36 | 66,057.90 | 66,899.52 | 66,828.45 |

| India Vix | 14.17 | 0.82 (6.14%) | 14.19 | 12.28 | 13.35 | 13.35 |

| Nifty Total Market | 12,743.90 | -148.40 (-1.16%) | 12,930.15 | 12,743.80 | 12,829.55 | 12,892.30 |

Key Spotlights:

- Nifty 50's Broad Dip: Closed at 25,059.95 (-0.91%), erasing early gains on banking weakness and FII caution—volumes steady amid Jaipur trader chatter.

- Nifty Bank's Rate Rut: Down 1.01% to 58,602.45, hit by NPA fears and lending slowdowns; peers like Bankex echoed the 1.13% slide.

- Financial Services Fade: Slipped 1.08% to 26,856.30 on insurance and NBFC margin pressures, with mid-caps amplifying the 1.64% drop.

- Vix Volatility Spike: Up 6.14% to 14.17, signaling heightened fear amid global cues—watch for escalation if earnings disappoint.

Bargain hunters may target dips in oversold financials (RSI <35), but risks persist if FII selling continues. Nifty support at 25,000—eye budget previews for uplift. NSE data; levels as of 1:39 PM IST on Jan 23.