U.S. markets witnessed sharp, stock-specific action on Friday, marked by explosive gains in select micro-cap names and steep losses in several warrants and biotech-linked stocks, while large-cap indices and ETFs remained relatively stable.

Top Gainers

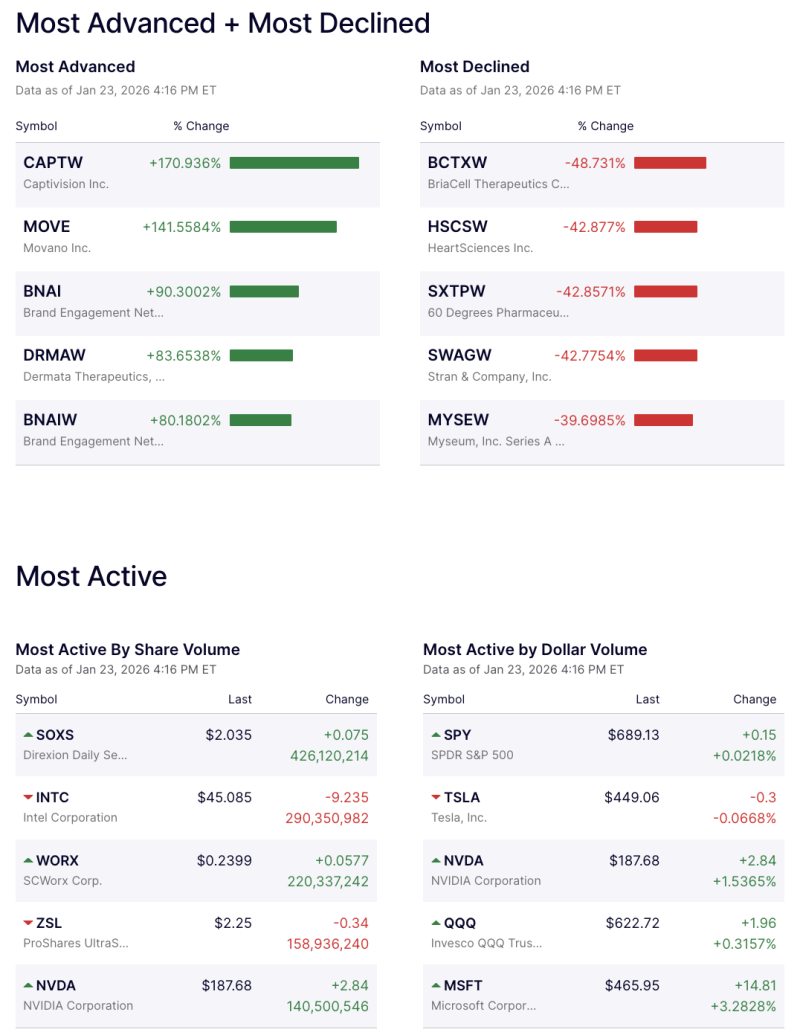

Captivision Inc. (CAPTW) topped the leaderboard with a staggering 171% surge, reflecting intense speculative interest. Movano Inc. (MOVE) followed closely, rallying over 141%, while Brand Engagement Network (BNAI) advanced 90%. Strong momentum was also seen in Derma Therapeutics (DRMAW) and BNAIW, both rising more than 80%, underscoring heightened risk appetite in low-float and warrant-heavy counters.

Top Losers

On the downside, biotech warrants dominated the decliners list. BriaCell Therapeutics (BCTXW) plunged nearly 49%, while HeartSciences (HSCSW) and 60 Degrees Pharmaceuticals (SXTPW) fell over 42% each. SWAGW and MYSEW also posted losses close to 40%, highlighting continued volatility and profit-taking in speculative healthcare plays.

Most Active – By Volume

Trading volumes were led by SOXS, with over 426 million shares exchanged, reflecting active positioning around semiconductor volatility. Intel (INTC) also saw heavy turnover, though the stock ended sharply lower. Among gainers, SCWorx (WORX) and NVIDIA (NVDA) attracted strong retail and institutional participation.

Most Active – By Dollar Volume

In dollar terms, large-cap names dominated. SPY held steady, while NVIDIA, QQQ, and Microsoft closed higher, signaling resilience in mega-cap technology. Tesla traded actively but ended marginally lower.

Market Takeaway

The session highlighted a clear bifurcation in market behavior: extreme momentum-driven moves in micro-caps and warrants contrasted with measured, constructive action in large-cap technology and index ETFs. Volatility remains elevated at the stock level, even as broader market stability persists.