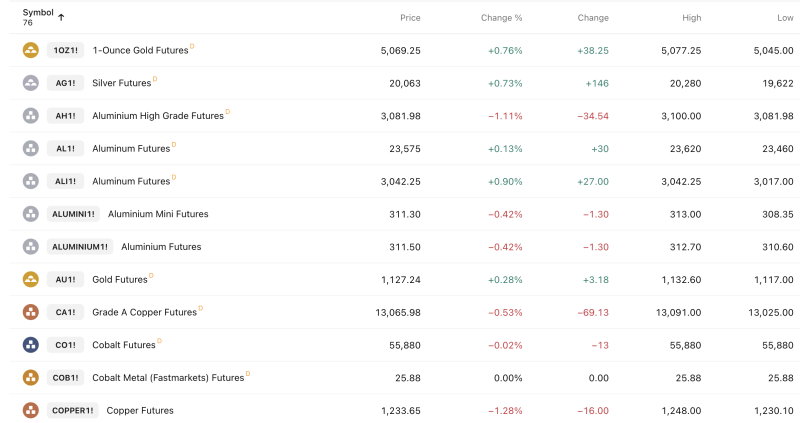

Market Summary: Commodity futures traded in a split session Wednesday, with a record-setting rally in the benchmark 10Z1 contract starkly contrasting against a broad sell-off in the industrial metals complex, underscoring deep sectoral divergences.

Index Performance & Key Movers:

The headline act was the 10Z1! futures contract, which climbed +38.25 points, or +0.76%, to settle at a session peak of 5,069.25. Strength was also seen in ALI1! (+0.90% to 3,042.25) and AG1! (+0.73% to 20,063).

The gains were overshadowed by significant pressure on core industrial materials. COPPER1! led the declines, falling -1.28% (-16.00) to 1,233.65. Aluminium contracts followed, with ALUMINIUM1! down -0.42% to 311.50. The CA1! (Nickel) contract fell -0.53% to 13,065.98.

Market Breadth:

Market internals reflected the tug-of-war. Advancers narrowly outnumbered decliners 7 to 4, with one contract unchanged. However, the concentrated losses in high-volume, economically sensitive base metals painted a more cautious picture than the positive breadth suggested.

Institutional Interpretation:

Analysts identified a clear sector-led, risk-off rotation within the commodity space. The momentum behind the benchmark index failed to catalyze broader risk appetite, revealing fragile sentiment. The simultaneous weakness in copper, aluminium, and nickel points to mounting concerns over global industrial demand and tightening monetary conditions. The session's low volatility—evident in narrow trading ranges like COB1! (0.00% change)—indicates a wait-and-see approach from major participants, awaiting clearer macroeconomic signals.

Outlook:

Traders are expected to scrutinize upcoming industrial production and inventory data for direction, with the divergence between market segments likely to persist until a unified demand narrative emerges.