Mumbai: Bluestone Jewellery and Lifestyle Ltd. reported a sharp rise in revenue for FY25, but continued to remain in the red as higher expenses weighed on profitability.

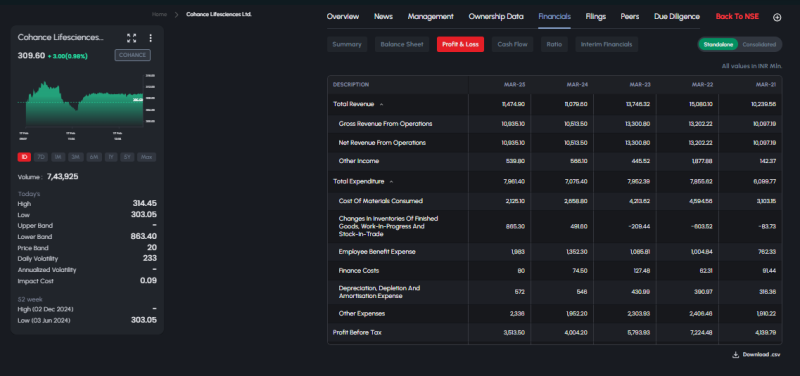

The company’s total revenue for FY25 stood at ₹18,299.20 million, marking a significant jump from ₹13,034.91 million in FY24 and ₹7,878.94 million in FY23, reflecting strong growth in operations.

Gross and net revenue from operations both rose to ₹17,700.02 million in FY25, compared to ₹12,658.39 million in FY24.

Costs Outpace Revenue Growth

Despite robust top-line growth, total expenditure increased sharply to ₹20,491.34 million in FY25 from ₹14,457.27 million in the previous fiscal.

Key cost drivers included:

Cost of materials consumed: ₹17,215.35 million (vs ₹12,348.71 million in FY24)

Employee benefit expenses: ₹2,022.43 million (vs ₹1,384.25 million)

Finance costs: ₹2,075.42 million (vs ₹1,378.71 million)

Depreciation and amortisation: ₹1,474.75 million (vs ₹952.68 million)

Other expenses also increased to ₹3,933.95 million, up from ₹3,200.24 million in FY24.

Losses Persist

The company reported a loss before tax of ₹2,192.14 million in FY25, widening from a loss of ₹1,422.36 million in FY24. Losses were also reported in previous years, highlighting continued margin pressure despite scale expansion.

Inventory adjustments reflected a negative change of ₹6,230.46 million during FY25.

Stock Performance

Shares of Bluestone were trading at ₹404.80, down 1.39% in the latest session. The stock has seen a 52-week high of ₹793.00 and a low of ₹403.40.