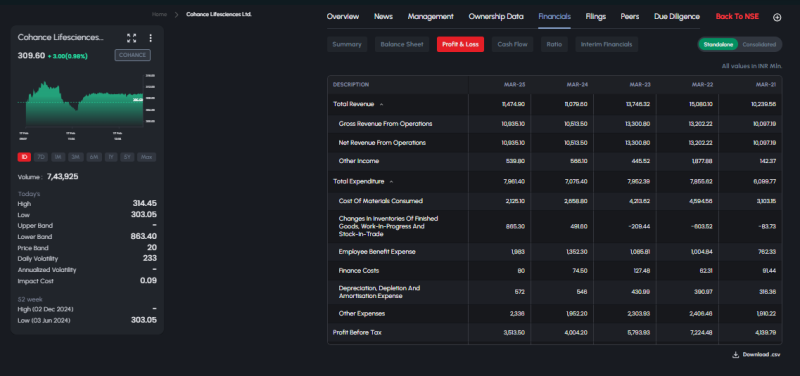

Mumbai: Cohance Lifesciences Ltd. reported improved revenue performance in FY25, with total revenue rising to ₹11,474.90 million, compared to ₹10,079.60 million in FY24, indicating a recovery in business momentum after two years of decline.

Gross revenue from operations stood at ₹10,935.10 million in FY25, up from ₹10,513.50 million in the previous fiscal. Other income declined marginally to ₹539.80 million from ₹568.10 million.

Expenditure Trends

Total expenditure increased to ₹7,961.40 million in FY25 from ₹7,075.40 million in FY24.

Key cost components included:

Cost of materials consumed: ₹2,125.10 million (vs ₹2,658.80 million in FY24)

Employee benefit expense: ₹1,983 million (vs ₹1,352.30 million)

Depreciation and amortisation: ₹572 million (vs ₹546 million)

Finance costs: Nil in FY25 (vs ₹74.50 million in FY24)

Other expenses rose to ₹2,336 million from ₹1,952.20 million, reflecting higher operational spending.

Profit Performance

Profit before tax (PBT) stood at ₹3,513.50 million in FY25, compared to ₹4,004.20 million in FY24, indicating margin pressure despite higher revenue. The company had reported significantly higher PBT of ₹5,793.93 million in FY23 and ₹7,224.48 million in FY22.

Inventory adjustments showed a positive impact of ₹865.30 million in FY25, compared to ₹491.80 million in FY24.

Stock Movement

Shares of Cohance Lifesciences were trading at ₹309.60, up 0.98% in the latest session, with the stock hovering near its 52-week low of ₹303.05.