Global equity markets closed on a mixed note with divergent trends across major regions as investors weighed growth signals, volatility cues, and regional momentum.

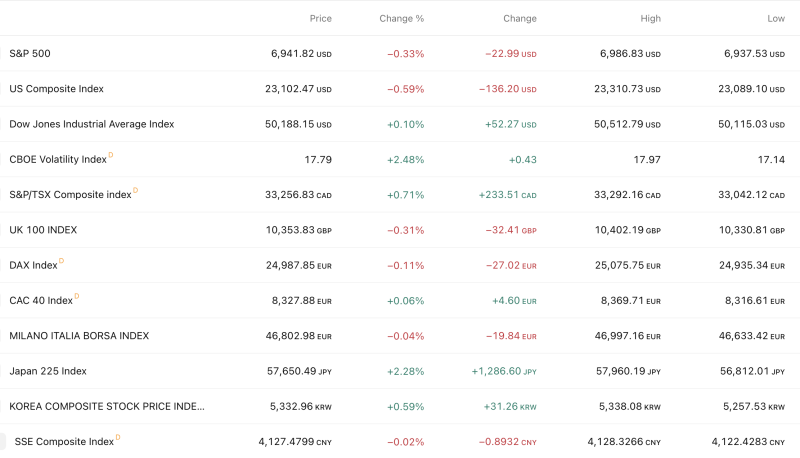

In the United States, the Dow Jones Industrial Average edged higher by 0.10% to close at 50,188, supported by selective strength in industrial and defensive names. However, broader markets remained under pressure with the S&P 500 declining 0.33% to 6,941, while the US Composite Index fell 0.59%, reflecting weakness in growth and tech-heavy segments. The CBOE Volatility Index (VIX) rose 2.48%, indicating slightly elevated market uncertainty.

European markets were largely muted. The UK FTSE 100 slipped 0.31%, while Germany’s DAX declined 0.11%. France’s CAC 40 managed a marginal gain of 0.06%, and Italy’s FTSE MIB remained nearly flat, highlighting cautious investor positioning across the region.

In Asia, markets showed stronger momentum. Japan’s Nikkei 225 surged 2.28%, emerging as the top performer among major global indices, driven by broad-based buying and positive domestic sentiment. South Korea’s KOSPI rose 0.59%, while China’s Shanghai Composite ended nearly flat with a slight 0.02% dip.

Meanwhile, Canada outperformed developed peers with the S&P/TSX Composite gaining 0.71%, supported by strength in commodities and financials.

Overall, global markets reflected a mixed risk tone, with strength in Asia offsetting mild weakness in the US and Europe as investors continue to monitor macro signals, volatility trends, and cross-market liquidity.