November 23, 2025 – In the most explosive week of 2025 so far, startups across the US, India, and UK collectively raised over $7.5 billion, driven by frontier AI, biotech, and pre-holiday term-sheet rushes.

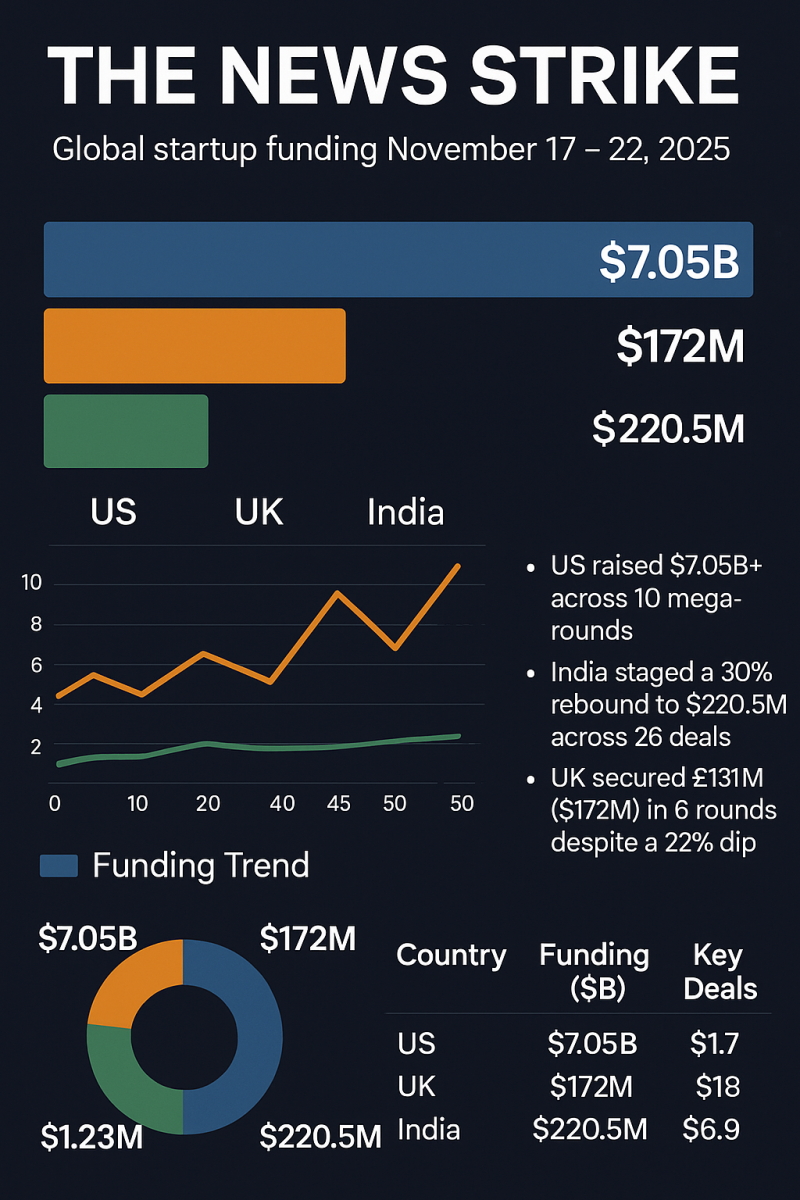

The United States dominated with $7.05 billion+ across just 10 mega-rounds (average $705M), India staged a sharp 30% rebound to $220.5M across 26 deals, and the UK secured £131M ($172M) in six rounds despite a 22% dip. AI captured 68% of global capital this week.

Global Top 15 Funding Deals (Nov 17–22, 2025)

| Rank | Startup | Country | Amount | Sector | Lead Investors / Notes |

|---|---|---|---|---|---|

| 1 | Lambda | USA | $1.5B | AI Cloud Infrastructure | TWG Global (Tull/Walter) |

| 2 | Kalshi | USA | $1B | Predictions Market | Sequoia, CapitalG → $11B valuation |

| 3 | Luma AI | USA | $900M | Multimodal AI Video | Humain, AMD |

| 4 | Kraken | USA | $800M | Crypto Exchange | Citadel Securities → $20B valuation |

| 5 | Physical Intelligence | USA | $600M | Robotics AI | CapitalG, Bezos, Thrive → $5.6B val |

| 6 | Artios Pharma | UK | $115M (£87M) | Cancer Biotech (DDR) | SV Health, RA Capital → runway to 2027 |

| 7 | Ramp | USA | $300M | Fintech Spend Management | Lightspeed → $32B valuation (4th raise in 2025) |

| 8 | Function Health | USA | $298M | Longevity/Health Testing | Redpoint → $2.5B valuation |

| 9 | Genspark | USA | $275M | Agentic AI | $1.25B valuation, >$50M ARR in 5 months |

| 10 | Suno | USA | $250M | AI Music | Menlo Ventures → $2.45B valuation |

| 11 | Yubi Group | India | $46.3M | Fintech Debt Platform | EvolutionX, founder |

| 12 | Vyntelligence | UK | $30M (£23M) | Agentic Video AI | Blume Equity, Morgan Stanley 1GT |

| 13 | AgroStar | India | $30M | Agritech | Just Climate |

| 14 | Tractor Junction | India | $22.5M | Agritech Mobility | Astanor, Info Edge |

| 15 | PolyModels Hub | UK | £7M | Pharma R&D AI | Molten Ventures (18 months post-seed) |

Country-by-Country Snapshot

United States ($7.05B+ across 10 rounds)

- Biggest week ever tracked by Crunchbase Megadeals Board

- 6 of top 10 deals were pure AI; crypto & fintech roared back

- Four startups now valued >$10B privately (Ramp $32B, Kraken $20B, Kalshi $11B, Physical Intelligence $5.6B)

India ($220.5M across 26 deals – up 30% WoW)

- First meaningful rebound after three weeks of sub-$170M

- Bengaluru 54% of deals; AI (5 rounds), fintech, spacetech, agritech led

- Debt and early-stage surged; Yubi & AgroStar topped growth list

United Kingdom (£131M / $172M across 6 rounds – down 22% WoW)

- Health/biotech took 70% of capital (Artios + PolyModels + Emm)

- Pension money flowing: new £200M British Growth Partnership closed first tranche

- AI (Vyntelligence) and spacetech grants (£6.9M via UKSA/ESA) rounded out activity

Key Themes This Week

- AI is eating the world – 68% of global capital went to AI infrastructure, agentic tools, robotics, video, music, and healthcare applications.

- Pre-holiday mega-rush – US investors cleared term sheets before Thanksgiving; similar pattern seen in India and UK.

- Health tech renaissance – From cancer DDR (Artios) to longevity testing (Function Health) and smart menstrual cups (Emm).

- Crypto & predictions markets are back – Kalshi ($11B) and Kraken ($20B) signal institutional return.

- Pension capital unlocking – UK’s Mansion House reforms and India’s SIDBI Antariksh spacetech fund show institutional dry powder entering startups.

Outlook for Rest of 2025

- US on pace for $220B+ annual venture total (highest since 2021)

- India likely to finish at $14–15B (flat-to-slightly-up vs 2024)

- UK heading toward £15–16B, buoyed by pension inflows and Labour government’s science budget

The gap between US mega-AI rounds and the rest of the world has never been wider — but India and the UK are showing clear signs of life in AI, health, and deep tech.