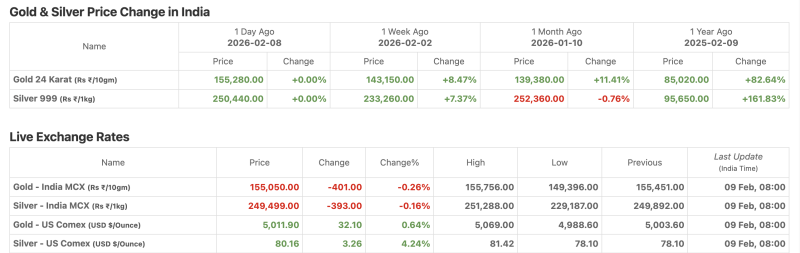

Gold remained broadly steady in India while silver showed stronger global momentum, with data indicating mixed short-term movement but powerful long-term gains in precious metals.

Gold (24K, India) held at ₹1,55,280 per 10 gm (flat day-on-day), reflecting stability after a sharp rally. On a broader horizon, gold has surged 8.47% in one week, 11.41% in one month, and an exceptional 82.64% over the past year, highlighting sustained bullish momentum.

However, MCX Gold slipped ₹401 (-0.26%) to ₹1,55,050, tracking minor profit-booking, even as global cues remained supportive. Internationally, Gold on US Comex rose 0.64% to $5,011.90, staying above the key $5,000 mark, with an intraday high of $5,069.

Silver (999, India) remained flat day-on-day at ₹2,50,440/kg, but continues to show strong structural strength, gaining 7.37% in a week and delivering a massive 161.83% rally over the past year despite a mild 0.76% monthly dip.

On the derivatives front, MCX Silver eased ₹393 (-0.16%) to ₹2,49,499, while global momentum stayed strong as Silver on US Comex jumped 4.24% to $80.16, significantly outperforming gold in the latest session.

Market Insight:

Gold is consolidating near record levels with strong yearly momentum intact.

Silver is outperforming globally, supported by both investment and industrial demand.

Minor MCX declines reflect short-term profit booking rather than trend reversal.

Overall Trend: Precious metals remain in a structural uptrend led by long-term bullish momentum, with silver showing stronger near-term acceleration while gold holds firm above key psychological levels.