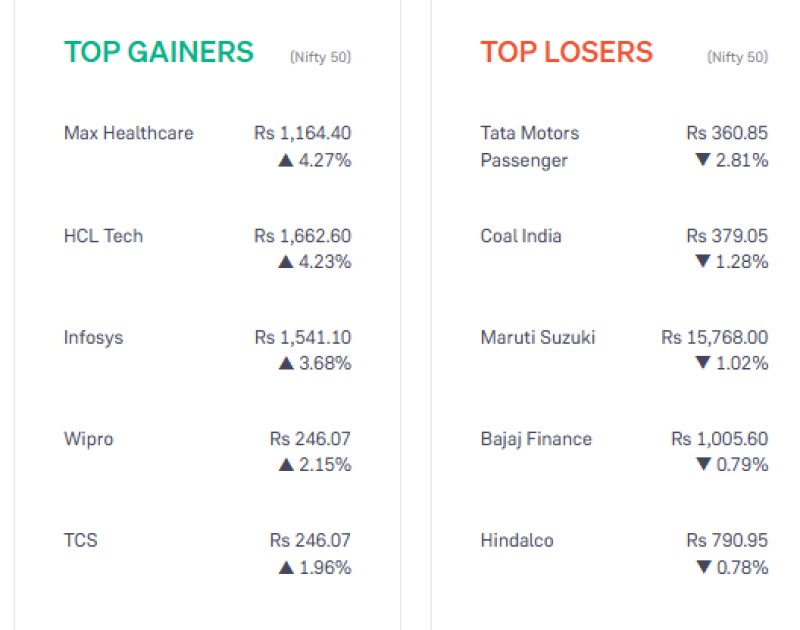

Bullish sentiment returned to the Nifty 50 index today, driven by a decisive rally in the Information Technology sector and a standout performance by Max Healthcare. While the broader market showed mixed signals with weakness in the auto sector, the day belonged to growth stocks, with four of the top five gainers hailing from the IT pack.

Sector Rotation: IT Stocks Lead the Charge

The most significant trend of the trading session was the buying interest across major technology counters. Investors appear to be rotating capital back into IT services, driving substantial gains across the board.

HCL Tech emerged as the leader of the tech pack, surging 4.23% to close at Rs 1,662.60. Close behind was Infosys, which posted a strong recovery, climbing 3.68% to Rs 1,541.10.

The buying momentum extended to other industry heavyweights as well. Wipro gained 2.15%, and TCS rose by 1.96%, cementing a sector-wide trend that suggests renewed investor confidence in the technology outlook.

Top Performer: Max Healthcare

While the IT sector provided the bulk of the momentum, Max Healthcare claimed the spot as the single best performer on the index. The stock rallied 4.27% to settle at Rs 1,164.40, outperforming its peers and signaling strong institutional interest in the healthcare space.

Market Context

The rally in these sectors helped offset losses in the Auto and Metal indices. Notable laggards included Tata Motors Passenger (-2.81%) and Coal India (-1.28%), indicating a clear divergence where funds moved away from cyclical commodities and manufacturing into service-oriented sectors.

Data Focus: Top Gainers (Nifty 50)

| Company | Market Price (Rs) | Change (%) |

|---|---|---|

| Max Healthcare | 1,164.40 | + 4.27% |

| HCL Tech | 1,662.60 | + 4.23% |

| Infosys | 1,541.10 | + 3.68% |

| Wipro | 246.07 | + 2.15% |

| TCS | 246.07* | + 1.96% |

> Note on Data: The source display indicates an identical closing price for Wipro and TCS (Rs 246.07). This is likely a data feed error in the original display, as TCS typically trades at a significantly higher valuation, though the percentage gain (+1.96%) reflects the correct market movement.