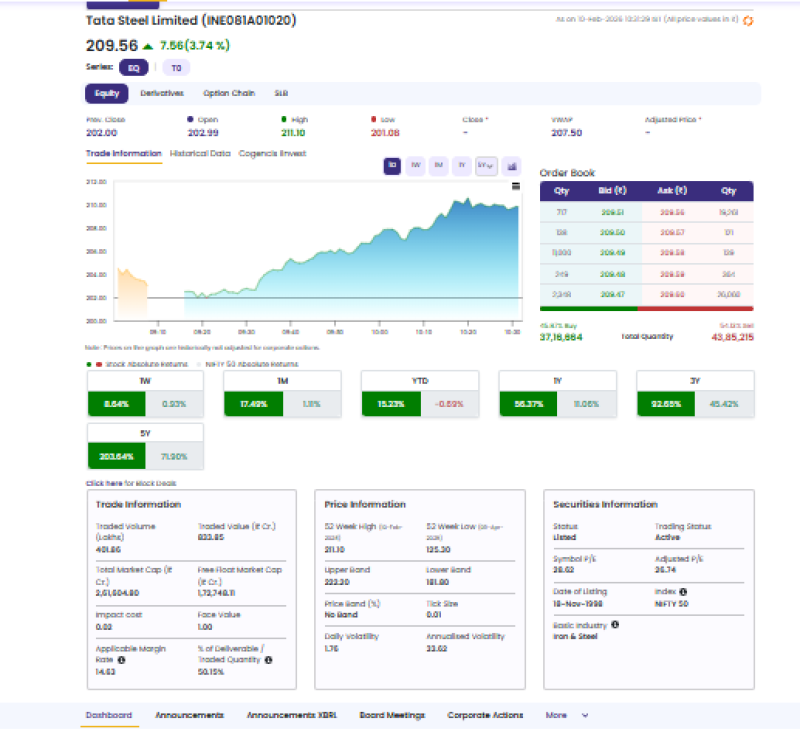

Tata Steel witnessed strong buying momentum in today’s session, rising 3.74% to ₹209.56, signalling renewed bullish interest in metal stocks. The move comes as traders continue to accumulate positions amid strengthening price structure and positive sector sentiment.

The stock traded between a high of ₹211.00 and a low of ₹201.08, indicating sustained upward pressure through the session. Market depth also reflected buying dominance, with bid quantities consistently matching or exceeding sell-side pressure, suggesting institutional participation.

From a trend perspective, Tata Steel remains structurally strong. The stock has delivered 15.22% returns on a YTD basis and an impressive 56.37% gain over 1 year, highlighting sustained medium-term momentum. Over a longer horizon, the stock has surged 92.65% in 3 years, reinforcing its leadership within the metal pack.

Technically, the current rally indicates continuation momentum rather than a short-term spike. Traders are watching whether the stock sustains above the ₹210–₹212 resistance zone, which could open the door for further upside. On the downside, ₹202–₹204 remains a key support range where buyers are likely to re-enter.

For investors, the ongoing strength suggests Tata Steel remains in an accumulation phase supported by sector tailwinds and improving price structure. Sustained momentum above resistance could reinforce the bullish trend in the near term.