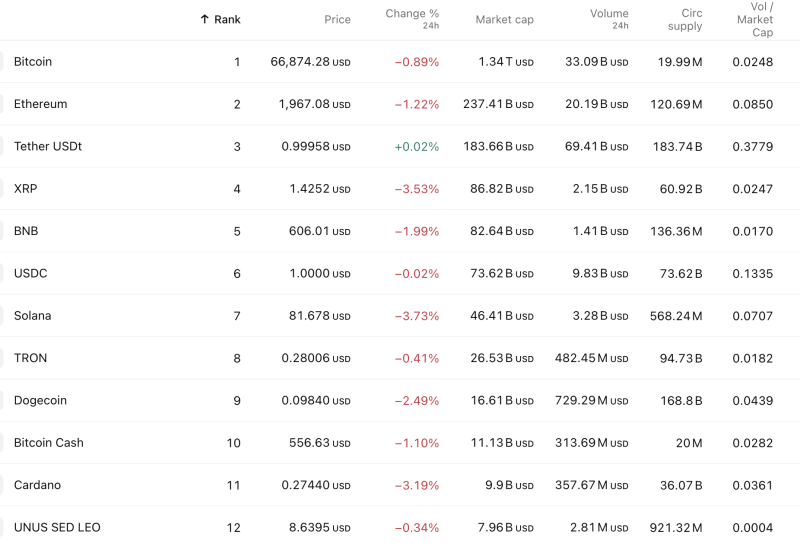

The crypto market closed sharply lower with broad-based declines across major assets, signaling risk-off sentiment and fading bullish momentum. Heavy selling in altcoins outweighed stability in stablecoins, while market leaders struggled to hold ground.

Altcoins Lead the Fall

Losses were led by high-beta names, with Solana plunging -3.73%, the steepest drop among top assets, reflecting aggressive profit-booking and weakening momentum. XRP tumbled -3.53%, while Cardano slid -3.19%, highlighting sustained pressure across large-cap altcoins.

Memecoin Dogecoin fell -2.49%, and BNB dropped -1.99%, extending the selloff across speculative and exchange-linked tokens.

Bitcoin and Ethereum Under Pressure

Market bellwether Bitcoin slipped -0.89% to $66,874, showing relative resilience but failing to trigger buying momentum. Ethereum declined -1.22%, remaining under steady distribution as risk appetite cooled.

Liquidity Rotation Visible

Stablecoins held firm amid volatility, with Tether (USDT) marginally up +0.02% and USDC nearly flat (-0.02%), indicating capital rotation toward safety rather than fresh inflows into risk assets.

Broader Market Tone

TRON: -0.41% (mild decline, defensive performance)

Bitcoin Cash: -1.10% (steady but weak)

UNUS SED LEO: -0.34% (low volatility, thin volume)

Momentum Check

Out of the top 12 assets, 9 closed in the red, confirming a broad market selloff. Sharp declines in Solana, XRP, and Cardano suggest weakening altcoin momentum, while Bitcoin’s limited fall indicates cautious positioning rather than panic. Stablecoin strength points to defensive capital flow — a key signal traders will watch for the next directional move.