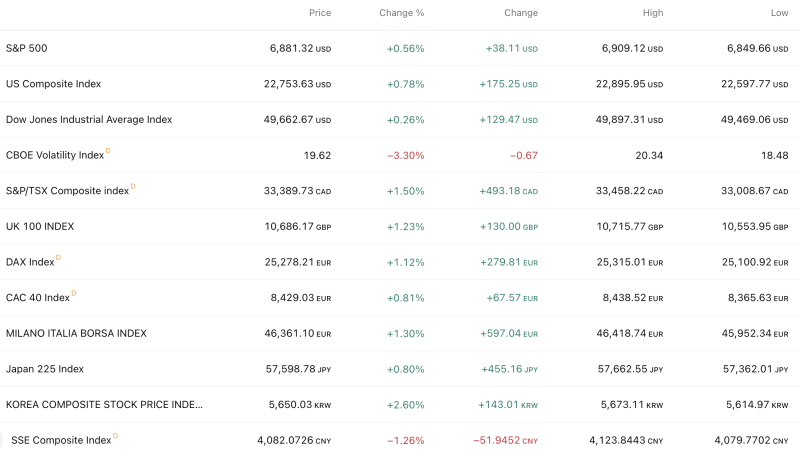

Global equities closed on a firm footing with broad-based gains across the US, Europe, and Asia, signaling sustained risk-on sentiment. Strong momentum in North America and Asia outweighed weakness in China, while volatility cooled notably.

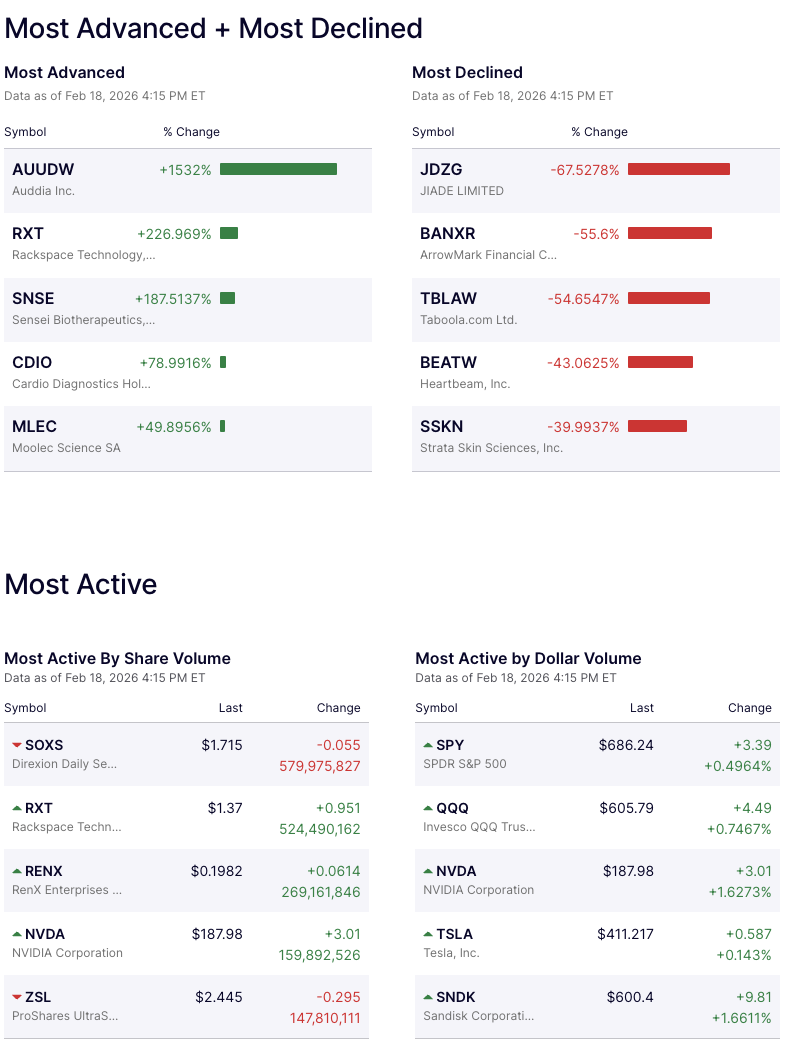

Top Gainers Lead the Charge

South Korea emerged as the session’s strongest performer, with the Korea Composite Stock Price Index soaring +2.60%, the biggest percentage gain among major global benchmarks, reflecting aggressive buying and strong regional momentum.

Canada’s S&P/TSX Composite Index followed with a sharp +1.50% rise, marking one of the strongest advances in developed markets. European bourses also remained firmly in the green:

UK 100 advanced +1.23%

Germany’s DAX climbed +1.12%

Italy’s Milano Borsa Index gained +1.30%

France’s CAC 40 added +0.81%

Japan’s Nikkei 225 posted a steady +0.80% increase, extending Asia’s positive tone.

Wall Street Holds Firm, Volatility Drops

US markets ended higher with moderate but stable gains:

S&P 500 rose +0.56%

Nasdaq Composite gained +0.78%

Dow Jones Industrial Average edged up +0.26%

Meanwhile, the CBOE Volatility Index (VIX) dropped -3.30%, indicating declining market fear and improved investor confidence.

Biggest Loser: China Under Pressure

China’s SSE Composite Index stood out as the only major laggard, slipping -1.26%, reflecting persistent selling pressure and weak sentiment in mainland equities.

Momentum Check

The session clearly favored bulls, with 10 of 12 major indices closing higher. Strength in Korea, Canada, and Europe suggests continued global risk appetite, while falling volatility reinforces short-term bullish momentum. However, China’s weakness remains a key divergence investors will monitor closely in upcoming sessions.