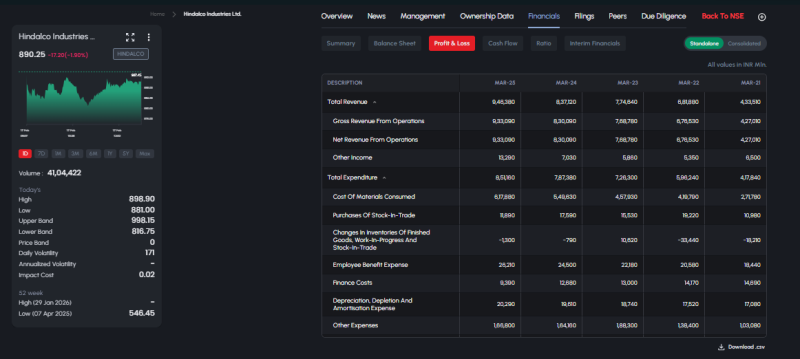

Mumbai: Hindalco Industries Ltd. reported a strong top-line performance for FY25, with total revenue rising to ₹9,46,380 crore, compared to ₹8,37,120 crore in FY24, reflecting steady year-on-year growth driven by improved operational performance.

The company’s gross revenue from operations stood at ₹9,33,090 crore in FY25, up from ₹8,30,090 crore in the previous fiscal. Net revenue from operations also mirrored the same growth trajectory.

Expenditure Sees Notable Increase

Total expenditure during FY25 rose to ₹8,51,180 crore, compared to ₹7,87,380 crore in FY24, indicating higher operational and input costs.

Cost of materials consumed increased to ₹6,17,880 crore from ₹5,49,630 crore.

Employee benefit expenses rose to ₹28,210 crore versus ₹24,500 crore last year.

Depreciation, depletion and amortisation expenses climbed to ₹20,290 crore, reflecting capital investments and asset expansion.

Finance costs, however, declined to ₹9,390 crore from ₹12,880 crore, signaling improved debt management and financial efficiency.

Other Income & Operational Adjustments

Other income nearly doubled to ₹13,290 crore in FY25 from ₹7,030 crore in FY24, supporting overall earnings.

Inventory changes showed a marginal contraction of ₹1,300 crore during FY25, compared to a ₹790 crore decline in FY24, indicating stable production-demand alignment.

Market Performance

Shares of Hindalco were trading at ₹890.25, down 1.90% in the latest session, with a day’s high of ₹898.90 and low of ₹881.00. The stock has witnessed a 52-week high of ₹— (as per screen data) and a 52-week low of ₹546.45.