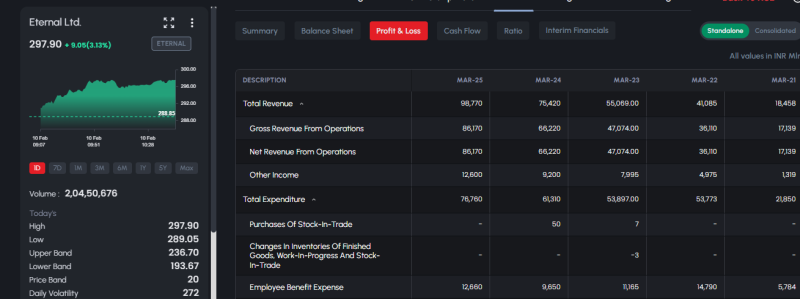

Shares of Eternal Ltd moved sharply higher in today’s session, climbing 3.13% to ₹297.90, supported by strong trading volumes and improving financial momentum. The stock witnessed steady buying interest through the session, indicating accumulation at higher levels.

Intraday, Eternal traded within a range of ₹289.05–₹297.90, closing near the day’s high, which signals sustained bullish sentiment. The counter recorded heavy activity with over 2.04 crore shares traded, reinforcing strong market participation.

Financially, the company continues to show consistent growth. Total revenue rose to ₹98,770 crore in FY25, compared to ₹75,420 crore in FY24, reflecting strong operational expansion. Net revenue from operations also improved to ₹86,170 crore, while other income increased to ₹12,600 crore, indicating diversified earnings strength.

On the cost side, total expenditure stood at ₹76,760 crore, with employee benefit expenses rising moderately, suggesting scaling operations alongside growth.

From a price-action perspective, Eternal remains in a steady uptrend, holding near the upper band and showing controlled volatility. Sustained trading above the ₹300 psychological level could trigger further upside momentum, while ₹289–₹292 remains immediate support.

The combination of strong revenue growth, rising participation, and positive price structure indicates continued investor interest in the stock.