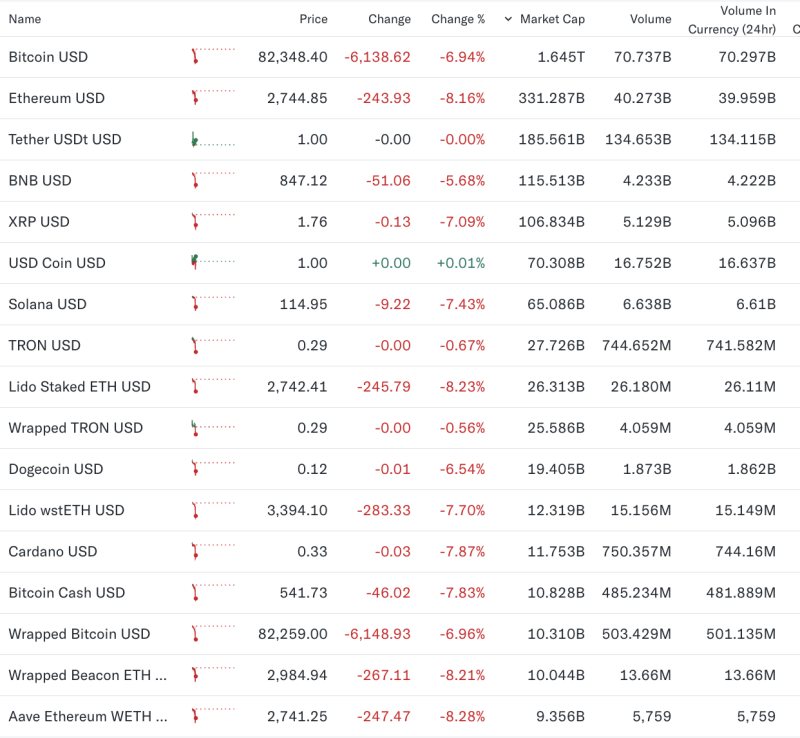

The cryptocurrency market witnessed a sharp and broad-based sell-off on Thursday, with Bitcoin, Ethereum and major altcoins coming under heavy pressure, erasing billions of dollars in market capitalisation.

Bitcoin tumbled 6.94% to $82,348, losing over $6,100 in a single session and dragging its market capitalisation down to $1.64 trillion. Trading volumes remained elevated at over $70 billion, indicating aggressive unwinding of positions.

Ethereum saw even steeper losses, plunging 8.16% to $2,744, wiping out nearly $244 per token. The second-largest cryptocurrency’s market value slipped to around $331 billion, while 24-hour volumes stood close to $40 billion.

The sell-off extended across major altcoins:

Solana dropped 7.43% to $114.95,

XRP fell 7.09% to $1.76,

BNB declined 5.68% to $847,

Cardano slid 7.87% to $0.33,

Dogecoin lost 6.54% to $0.12.

Ethereum-linked assets were among the worst hit. Lido Staked ETH, wstETH, and Wrapped Beacon ETH declined between 7.7% and 8.3%, highlighting stress across the decentralised finance (DeFi) ecosystem.

Bitcoin Cash plunged 7.83%, while Wrapped Bitcoin mirrored Bitcoin’s fall, sliding nearly 7% to around $82,259.

Stablecoins Tether (USDT) and USD Coin (USDC) remained largely unchanged at $1, though heavy volumes suggested capital rotation into low-volatility assets amid rising uncertainty.

Market participants attributed the sharp correction to global risk-off sentiment, profit booking after recent rallies, and concerns over tighter financial conditions. The magnitude of losses across both large-cap and mid-cap tokens signals heightened volatility in the near term.