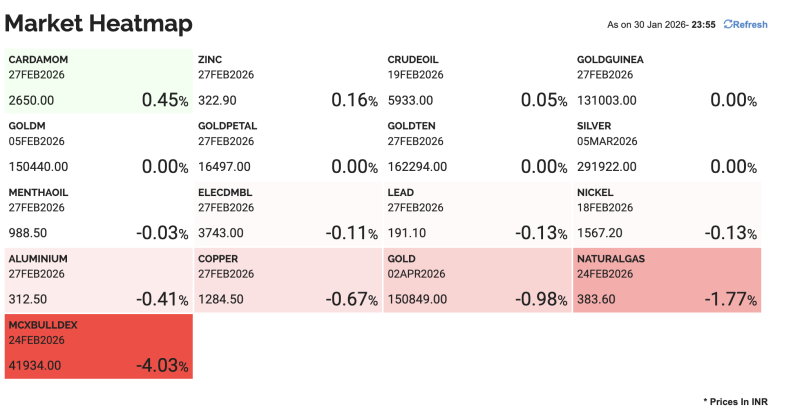

Gold and silver prices witnessed a sharp and sudden crash on Friday, January 30, just days ahead of the Union Budget 2026, rattling investors across physical and ETF markets. Silver ETFs plunged 20–23% in a single session, while gold ETFs also saw steep declines, raising a critical question for investors: Is this fall merely profit-booking, or has the historic rally in precious metals finally peaked?

How Big Was the Gold-Silver Crash?

The sell-off in precious metals-linked exchange-traded funds (ETFs) ranks among the steepest in recent years. Silver ETFs bore the brunt of the correction:

SBI Silver ETF fell nearly 22%

ICICI Prudential Silver ETF dropped around 23%

Zerodha, Nippon India and Kotak Silver ETFs declined close to 20%

Gold ETFs also slipped sharply:

Nippon India Gold ETF fell about 11%

ICICI Prudential Gold ETF declined nearly 8%

The abrupt correction shocked investors, especially those who entered the market during the recent rally.

What Led to the Sharp Fall in Gold and Silver Prices?

The primary trigger came from the United States, where President Donald Trump indicated that he may soon announce the successor to Federal Reserve Chair Jerome Powell. Markets interpreted this as a signal that the next Fed chief could adopt a more hawkish monetary stance, keeping interest rates higher for longer.

As a result:

The US dollar strengthened, with the Dollar Index rising about 0.4% to 96.60

Expectations of near-term rate cuts weakened

Profit booking accelerated in overbought commodities

A stronger dollar typically pressures gold and silver prices, as these commodities are dollar-denominated and become costlier for non-dollar investors.

Had Gold and Silver Become Overheated Before the Crash?

Yes. The correction followed an exceptionally strong rally:

Silver surged nearly 42% in January, its biggest-ever monthly gain

Gold rose over 15% in dollar terms, the strongest monthly rise since 1999

Spot gold touched a record $5,594 per ounce

Silver crossed $121 per ounce

Such rapid gains pushed both metals deep into the overbought zone, making them vulnerable to sharp corrections.

Is This the End of the Historic Rally in Gold and Silver?

Most commodity experts do not believe the long-term uptrend is over. Analysts view the current fall as a healthy correction after months of uninterrupted gains:

Gold has risen for six consecutive months

Silver was on a nine-month rally

Experts argue that periodic corrections are necessary to sustain longer-term bull markets.

Long-Term Fundamentals Still Strong

Despite the crash, structural drivers remain intact:

Silver demand continues to grow due to solar panels, electric vehicles, AI infrastructure and data centres

Central banks worldwide are steadily increasing gold reserves amid geopolitical and economic uncertainty

These factors continue to support a bullish long-term outlook for precious metals.