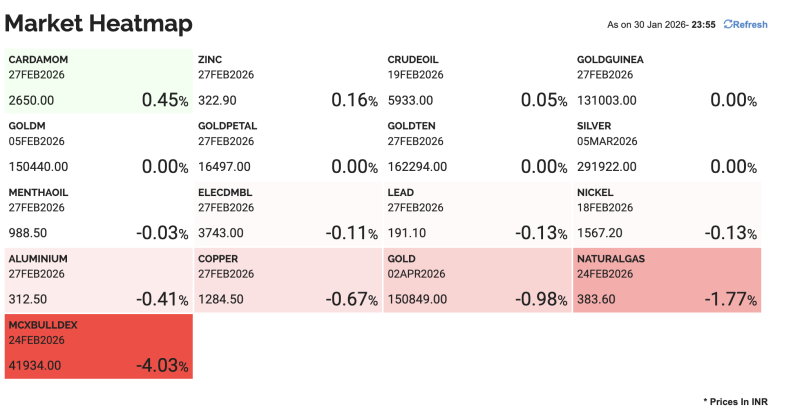

Commodity markets closed on a mixed note late Friday, with sharp weakness in the energy complex weighing on overall sentiment, while select agri commodities provided limited support. According to the MCX market heatmap as of late evening trade on January 30, 2026, Natural Gas and the broader commodity index were the key laggards, even as Cardamom posted modest gains.

Natural Gas futures for the February 24, 2026 contract declined sharply by 1.77% to ₹383.60, emerging as the worst performer on the board amid expectations of comfortable supply and muted demand outlook. Reflecting the broader pressure, the MCX Bullion & Metal Index (MCXBULLDEX) fell steeply by 4.03% to ₹41,934, signalling widespread weakness across commodity segments.

Precious metals traded largely flat to weak. Gold (April 2026) slipped 0.98% to ₹1,50,849, while Silver (March 2026) remained unchanged at ₹2,91,922, indicating cautious positioning by traders ahead of global macro cues. Gold-related contracts such as GoldM, Gold Petal, Golden and Gold Guinea showed negligible movement, suggesting a lack of fresh triggers.

Base metals remained under pressure, with Copper declining 0.67% to ₹1,284.50, Aluminium down 0.41% to ₹312.50, and Nickel easing 0.13% to ₹1,567.20. Lead also slipped 0.13%, while Zinc managed marginal gains of 0.16%, offering little relief to the metals pack.

On the energy front, Crude Oil prices edged up slightly by 0.05% to ₹5,933, providing limited stability, while Natural Gas remained the clear drag.

In contrast, the agri segment saw selective buying interest. Cardamom (February 2026) rose 0.45% to ₹2,650, standing out as the top gainer of the session. Mentha Oil was marginally lower, down 0.03%, while other agri-linked contracts traded largely sideways.

Overall, the heatmap reflected a risk-off tone in commodities, led by energy and metals, with traders remaining cautious amid global uncertainty and awaiting clearer cues on demand, interest rates and geopolitical developments.