US equities closed lower on Friday as a stronger dollar and renewed caution around risk assets weighed on sentiment, with technology and small-cap stocks underperforming broader benchmarks, while European markets advanced on improved investor confidence.

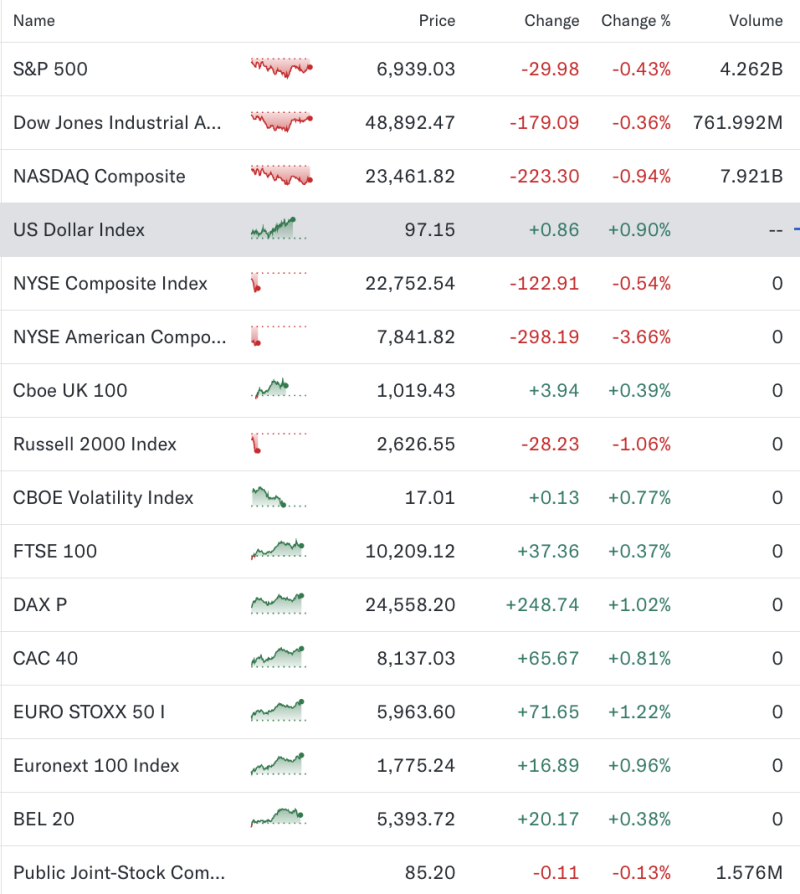

The S&P 500 slipped 0.43% to 6,939.03, while the Dow Jones Industrial Average fell 0.36% to 48,892.47. The Nasdaq Composite led declines, dropping 0.94%, reflecting selling pressure in growth and technology-heavy stocks.

Dollar Strength Pressures Risk Assets

The US Dollar Index climbed nearly 1%, rising to 97.15, marking one of its strongest daily gains in recent weeks. The dollar’s advance weighed on equities and commodities, as investors repositioned ahead of upcoming macroeconomic data and policy signals.

Market participants noted that currency strength, combined with elevated valuations, prompted profit-taking across US indices toward the end of the session.

Small Caps and Broader Market Underperform

The Russell 2000 Index, a gauge of small-cap stocks, declined 1.06%, underlining persistent caution around domestic growth-sensitive names. The NYSE Composite also ended lower, while the NYSE American Composite posted a sharper decline of over 3.6%, reflecting pressure in lower-liquidity segments of the market.

Meanwhile, volatility edged higher, with the CBOE Volatility Index (VIX) rising 0.77% to 17.01, suggesting modest risk aversion but no signs of market stress.

Europe Outperforms as Sentiment Improves

European equities outperformed US peers, closing broadly higher. Germany’s DAX rose 1.02%, while France’s CAC 40 gained 0.81%. The EURO STOXX 50 advanced 1.22%, supported by strength across industrials and financials.

UK markets also finished in positive territory, with the FTSE 100 up 0.37% and the Cboe UK 100 gaining 0.39%, aided by selective buying in heavyweight stocks.

Market View

Analysts said the divergence between US and European markets reflected differences in currency dynamics and valuation expectations.

“A firmer dollar and elevated US equity valuations are prompting investors to rotate selectively, while European markets continue to benefit from relatively attractive pricing,” a senior strategist at a global investment firm said.