Mumbai, December 22, 2025 – Indian equities extended losses in a choppy session on Monday, with the Nifty down 0.8% and Sensex slipping 0.6% as investors booked profits following last week's rally and amid concerns over rising U.S. bond yields impacting FII flows. At least 13 stocks hit their lower circuit limits, triggering trading halts and underscoring sector-specific pressures in e-commerce, textiles, and small-cap industrials.

The lower circuit breakers—ranging from 5% to 20%—kicked in early, with high-volume names like Meesho leading the rout on heavy selling. Analysts attribute the moves to a mix of disappointing quarterly updates, margin squeezes, and broader risk-off sentiment. Trading remains suspended for these scrips until the next session, pending exchange reviews.

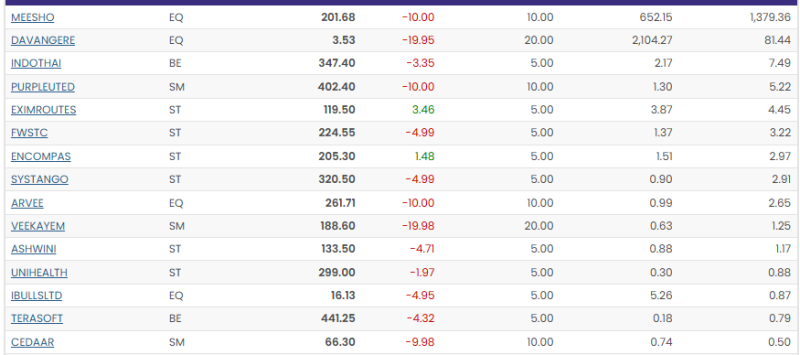

Top Lower Circuit Stocks by Traded Value

Here's a snapshot of the key names that locked at the floor, sorted by total traded value (in ₹ Cr):

| Rank | Stock Name | Series | LTP (₹) | Change (₹) | % Decline (Circuit) | Volume (Lakh Shares) | Traded Value (₹ Cr) |

|---|---|---|---|---|---|---|---|

| 1 | MEESHO | EQ | 201.68 | -10.00 | -10.00 | 6.52 | 1,379.36 |

| 2 | DAVANAGERE | EQ | 3.53 | -1.95 | -20.00 | 210.43 | 81.44 |

| 3 | INDOTHAI | BE | 34.70 | -3.85 | -10.00 | 0.22 | 7.44 |

| 4 | EXIMROUTES | ST | 119.50 | -3.46 | -5.00 | 0.39 | 4.45 |

| 5 | FWSTC | ST | 224.55 | -4.99 | -5.00 | 0.14 | 3.22 |

| 6 | ENCOMPAS | ST | 205.30 | -1.48 | -5.00 | 0.15 | 2.97 |

| 7 | SYSTANGO | ST | 320.50 | -4.99 | -5.00 | 0.09 | 2.91 |

| 8 | ARVEE | EQ | 186.71 | -10.00 | -10.00 | 0.07 | 2.65 |

| 9 | VEEKAYEM | SM | 188.50 | -9.81 | -20.00 | 0.08 | 1.27 |

| 10 | UNIHALTH | ST | 239.90 | -4.97 | -5.00 | 0.03 | 0.88 |

| 11 | IBULHSD | EQ | 16.13 | -4.95 | -5.00 | 0.53 | 0.87 |

| 12 | TEJAS | BE | 441.25 | -4.95 | -5.00 | 0.02 | 0.79 |

| 13 | CEDAR | SM | 68.30 | -9.88 | -10.00 | 0.07 | 0.50 |

Key Highlights:

- Meesho's Plunge: The e-commerce platform tanked 10% to ₹201.68 on reports of intensified competition from global players and softer festive sales data, wiping out ₹1,379 Cr in value.

- Davangere's 20% Lock: This sugar stock cratered the full 20% circuit to ₹3.53 amid cane procurement delays and ethanol policy uncertainties, with volumes surging 4x average.

- Small-Cap Bloodbath: Names like VEEKAYEM and ARVEE saw 20% and 10% drops respectively, fueled by leverage unwinding in the SME segment.

- Broader Impact: Sectors like logistics (Eximroutes, Fwstc) and healthcare (Unihalth) felt the heat, with 5% circuits triggered on thin liquidity.

Market participants eye RBI's commentary later this week for relief, while bargain hunters may eye rebounds in high-beta names. Stay tuned for post-market analysis. Data sourced from BSE/NSE; trading halts in effect.