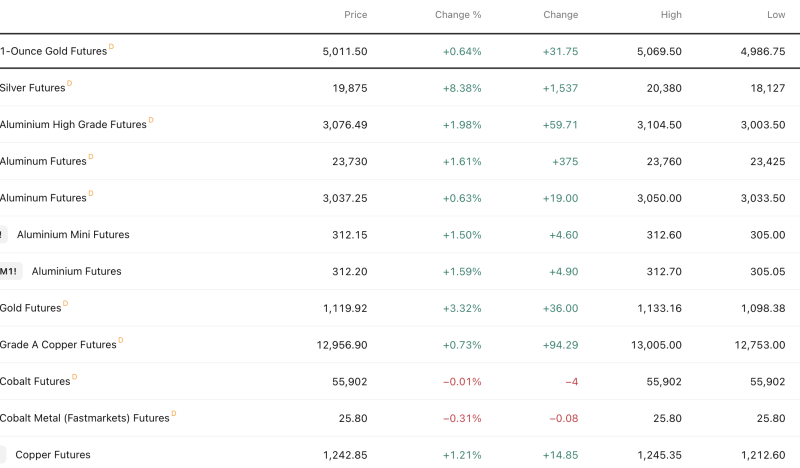

Commodities traded largely higher with precious metals and base metals showing strong momentum, led by a sharp rally in silver, while cobalt remained marginally weak.

Silver Futures emerged as the top performer, jumping 8.38% to 19,875, marking the strongest move across the commodity basket amid increased buying interest. 1-Ounce Gold Futures also advanced, rising 0.64% to 5,011.50, maintaining bullish positioning with an intraday high of 5,069.50. Broader Gold Futures climbed 3.32% to 1,119.92, reinforcing strength in safe-haven assets.

Among industrial metals, Aluminium High Grade Futures gained 1.98% to 3,076.49, while Aluminium Futures rose 1.61% to 23,730. Smaller contracts also remained firm, with Aluminium Mini Futures up 1.50% and another aluminium contract gaining 1.59%, indicating broad-based strength in the aluminium complex.

Copper remained positive, with Grade A Copper Futures up 0.73% to 12,956.90 and Copper Futures rising 1.21% to 1,242.85, supported by steady industrial demand signals.

In contrast, Cobalt Futures slipped marginally by 0.01% to 55,902, while Cobalt Metal Futures declined 0.31%, making cobalt the only weak segment in the commodities pack.

Market Insight:

Precious metals showed safe-haven and momentum buying, led by silver.

Base metals indicated steady industrial demand and pricing strength.

Weakness in cobalt suggests selective pressure in battery-linked metals.

Overall Trend: Broad commodity strength led by silver and gold, supported by gains across aluminium and copper, signals positive momentum in metals despite isolated weakness in cobalt.