Global equity markets traded with a cautious undertone on Thursday, as losses across Asian and European indices outweighed mild stability in select US and European benchmarks, keeping overall risk sentiment subdued.

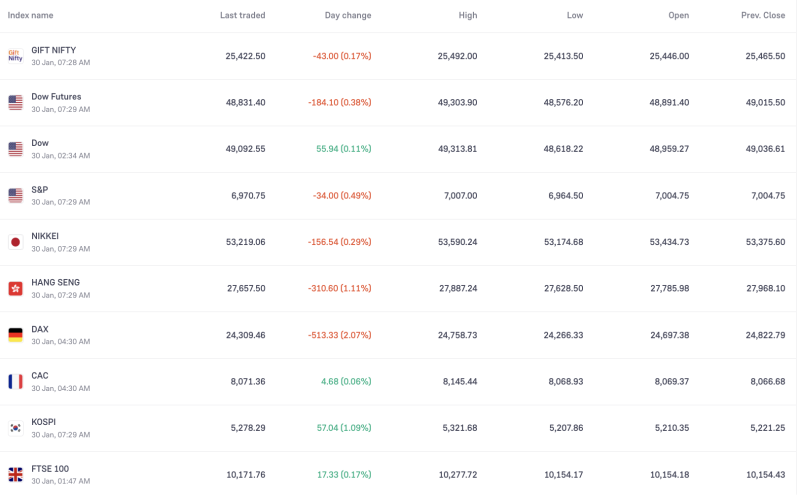

India-linked cues weakened early, with GIFT Nifty slipping 43 points or 0.17% to 25,422.5, indicating a muted start for domestic equities. The index traded within a narrow range, after opening at 25,446 and touching a low of 25,413.5.

In the US, Dow Futures declined 184 points (0.38%) to 48,831, signalling pressure ahead of the Wall Street open. In the previous session, the Dow Jones Industrial Average had managed marginal gains, closing up 56 points (0.11%) at 49,092, supported by selective buying.

Broader US markets, however, remained under pressure. The S&P 500 fell 34 points or 0.49% to 6,970, retreating from its intraday high of 7,007, reflecting investor caution around valuations and macro signals.

Asian markets were mixed but largely negative. Japan’s Nikkei 225 slipped 157 points (0.29%) to 53,219, while Hong Kong’s Hang Seng saw sharper selling, dropping 311 points or 1.11% to 27,657, emerging as one of the weakest performers in the region.

South Korea’s KOSPI bucked the trend, rising 57 points or 1.09% to 5,278, aided by strength in select heavyweight stocks.

European markets showed divergence. Germany’s DAX led losses, plunging 513 points or 2.07% to 24,309, reflecting heavy risk-off sentiment. France’s CAC 40 edged up marginally by 0.06% to 8,071, while the UK’s FTSE 100 gained 17 points or 0.17% to 10,171, offering limited stability.

Overall, the global market setup points to heightened volatility, with investors remaining selective amid mixed cues from the US, weakness in Asia, and sharp declines in key European indices.